Understanding the macroeconomic environment is crucial for traders looking to stay ahead. Singapore, as a premier financial hub in Asia, is uniquely positioned to benefit from—and be challenged by—global economic shifts. For traders in Singapore, 2025 promises to be a year marked by significant macro trends that will influence how investments are approached, risks are managed, and portfolios are diversified.

This article dives deep into these trends, offering insights to help Singaporean traders sharpen their strategies and navigate the complex market dynamics ahead.

Balancing Global Caution with ASEAN Growth Opportunities

With global growth slowing to a modest pace due to ageing populations, geopolitical tensions, and pandemic aftereffects, Singaporean traders should adopt a cautious, selective approach, focusing on defensive sectors and quality stocks offering stability and steady dividends. Simultaneously, Singapore’s strategic role in ASEAN presents strong growth prospects as regional integration deepens across emerging markets like Indonesia, Vietnam, and the Philippines.

Investing in regional ETFs or targeted sectors such as infrastructure and technology, along with cross-border arbitrage and sector rotation, allows traders to capture regional momentum while managing risks. This balanced strategy positions Singaporean investors to navigate 2025’s evolving macroeconomic environment effectively.

China’s Structural Shift and Its Impact on Singapore Markets

China’s economic transition from high-speed growth to a more sustainable, consumption-driven model is one of the most significant macro trends affecting Singaporean traders. With Beijing’s policy focus shifting towards stabilising the property market, promoting innovation (notably AI and green technology), and managing debt levels, investors must adjust their outlook accordingly.

For Singapore’s market, which is tightly linked to China through trade and investment flows, these shifts have tangible effects. Sectors such as technology, REITs (real estate investment trusts), and shipping are particularly sensitive to changes in Chinese demand. Traders should watch for signals from Chinese policy announcements and economic data, adjusting exposures to mitigate downside risks or capitalise on emerging growth themes like green energy and consumer technology.

Rising Interest Rates and Sticky Inflation

After years of historically low interest rates, 2025 is expected to bring a more nuanced monetary policy environment. Central banks like the US Federal Reserve, European Central Bank, and Singapore’s Monetary Authority of Singapore (MAS) face the challenge of managing inflation without triggering a recession.

For investors, higher interest rates mean increased borrowing costs and potential pressure on leveraged positions. Singaporean traders should consider reducing leverage and focusing on short-duration bonds or inflation-linked securities to hedge against rising costs. Additionally, value stocks—often characterised by stable cash flows and dividends—tend to perform better in such environments compared to high-growth, interest-rate-sensitive sectors.

Dividend-paying equities and sectors linked to essential goods and services may also attract more interest as investors seek income and defensive positioning.

Digital Assets and Tokenisation Trends

Singapore has emerged as a progressive hub for digital assets, with regulatory bodies like MAS encouraging the development of a robust, compliant digital asset ecosystem. This support, coupled with increasing institutional adoption across Asia, signals that digital assets will play a growing role in portfolio construction for sophisticated traders.

The rise of tokenised assets, including real estate tokens and stablecoins, offers new avenues for diversification and liquidity. Traders in Singapore should explore these innovations carefully, prioritising regulated platforms to manage risk effectively.

Decentralised finance (DeFi) adoption is also on the rise among experienced investors, providing opportunities for yield farming and liquidity provision. However, the complexity and volatility of crypto markets demand rigorous due diligence and risk management.

ESG and Sustainable Investing Mandates

Environmental, social, and governance (ESG) factors have moved beyond a trend to become central to investment decision-making, driven by both regulatory frameworks and investor demand. Singapore’s Green Plan 2030 underlines the nation’s commitment to sustainable development, including ambitions to grow regional carbon markets.

For traders, integrating ESG metrics into fundamental analysis is increasingly important. Allocations to green bonds, sustainable ETFs, and companies with strong ESG profiles are gaining traction. Additionally, shorting companies lagging in sustainability or those exposed to regulatory penalties can serve as an effective hedge.

This dual approach—embracing ESG leaders and managing ESG risks—can help Singaporean traders align portfolios with global sustainability trends while seeking performance.

Geopolitical Risk and Supply Chain Realignments

Geopolitical tensions remain a major variable for investors worldwide, and Singapore is no exception, given its open economy and central role in global trade. Ongoing US-China frictions, concerns over Taiwan, and instability in the Middle East contribute to market uncertainty.

Singapore’s position as a logistics and financial hub means supply chain disruptions have a direct impact on its economy and markets. Traders should consider hedging strategies using commodities, such as oil and precious metals, or exposure to defence sector equities, which often benefit from geopolitical tensions.

Diversifying supply chain exposure through ASEAN equities and engaging in scenario-based portfolio stress testing are prudent steps to manage potential shocks.

Regulatory Developments and Market Reforms

Regulatory environments worldwide are tightening, and Singapore continues to evolve its frameworks to protect investors and ensure market integrity. MAS has implemented stricter rules on retail trading, leverage limits, and digital asset oversight.

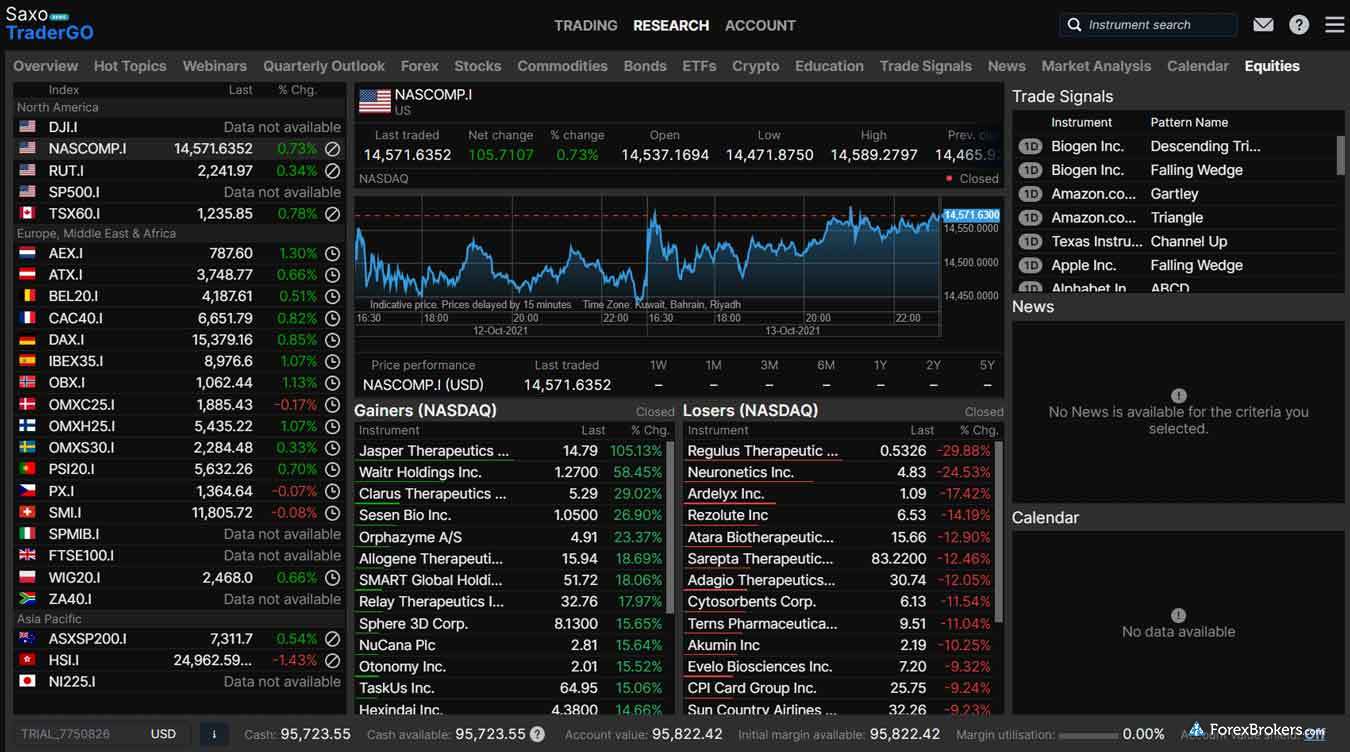

For traders, compliance and transparency become non-negotiable. Partnering with licensed brokers and platforms, such as Saxo Capital Markets Singapore, provides access to regulated services with robust protections.

Regulatory harmonisation efforts across markets can facilitate cross-border trading but also require vigilance to navigate evolving rules. Incorporating compliance into strategy design helps avoid penalties and reputational risk.

Conclusion

2025 presents a complex but opportunity-rich environment for Singaporean traders. By understanding and integrating the major macro trends—from slower global growth and regional integration to technological innovation and ESG imperatives—investors can build resilient, forward-looking portfolios.

Adapting strategies in line with these developments will be key to capturing growth while managing risk. Singapore’s vibrant financial ecosystem and regulatory leadership position traders to thrive if they stay agile, informed, and innovative in the year ahead.