In the ever-evolving world of finance, trading apps have become essential tools for anyone interested in market derivatives. These applications allow traders to engage with the markets conveniently, whether they are at home or on the go. In this blog post, we will discuss some of the best financial trading apps available for trading market derivatives, focusing on their features and benefits for both beginners and experienced traders.

Understanding Market Derivatives

Before we explore trading apps, it’s important to understand what market derivatives are. Derivatives are financial contracts whose value is linked to the price of an underlying asset, such as stocks, commodities, or currencies. Futures, swaps, and options are common forms of derivatives. These instruments are often used for hedging risks or speculating on price movements.

Essential Features of Trading Apps

When looking for the best trading app for market derivatives, consider the following key features:

- User friendly interface: A good trading app should be easy to navigate, allowing users to execute trades quickly and efficiently.

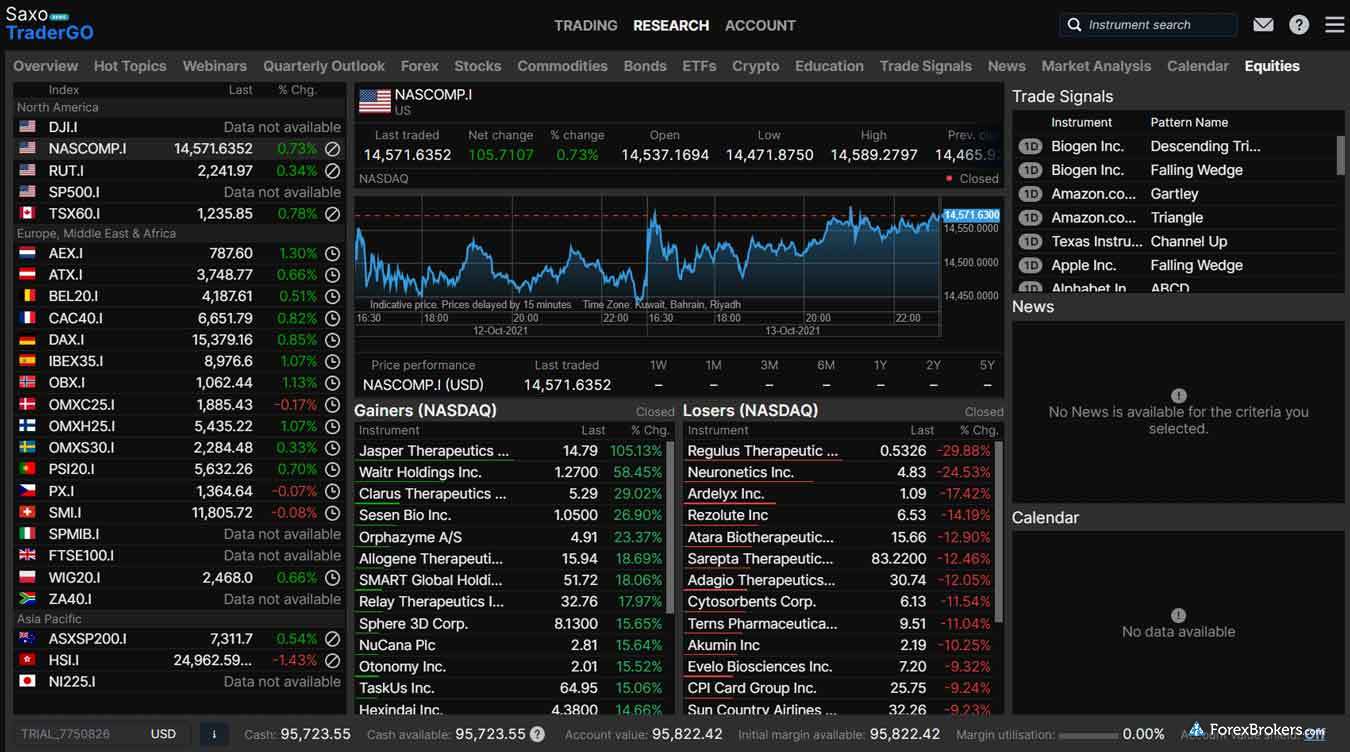

- Real time market data: Access to live market quotes, news updates, and analytics is crucial for making informed trading decisions.

- Advanced charting tools: Look for apps that offer comprehensive charting options, including technical indicators, drawing tools, and various chart types to analyse market trends.

- Efficient order execution: The ability to place orders swiftly and reliably is vital in the fast-paced trading environment to minimise potential losses.

- Educational resources: Many top trading apps provide educational materials, such as articles, videos, and webinars, to help users enhance their trading skills and knowledge.

Recommended Trading Apps for Market Derivatives

Here are the best trading apps that cater to market derivatives.

1. Comprehensive Trading Platforms

These apps provide a wide range of derivatives, including options and futures. They often come with advanced features for both analysis and execution, making them suitable for serious traders.

2. User-Friendly Options

Some apps are designed with beginners in mind, offering simplified interfaces and guided tutorials. These platforms help new traders learn the ropes while gaining access to essential trading tools.

3. Research and Analysis Tools

Certain applications focus on providing in-depth market research and analysis. They offer insights, forecasts, and expert opinions, helping traders make informed decisions based on market trends.

4. Social Trading Features

Some trading apps incorporate social trading elements, allowing users to follow and copy the trades of successful investors. This feature can be particularly beneficial for beginners who want to learn from experienced traders.

5. Cost-Effective Solutions

Many trading apps offer competitive pricing structures, including lower commissions and fees compared to traditional brokerage firms. This cost-effectiveness can significantly benefit traders, especially those who trade frequently.

Advantages of Using Trading Apps

Using trading apps for market derivatives comes with several advantages:

- Accessibility: Trading apps allow users to access the markets anytime and anywhere, providing flexibility in managing trades.

- Instant updates: Most apps deliver real-time data and alerts, keeping traders informed about market movements and news that could impact their positions.

- Customisation: Many apps allow users to customise their dashboards, watchlists, and alerts, tailoring the experience to their trading preferences.

- Learning opportunities: With integrated educational resources, traders can continuously enhance their knowledge and skills, making informed trading decisions.

- Community engagement: Some apps foster a sense of community among traders, allowing users to share insights, strategies, and experiences.

Tips for Choosing the Right Trading App

Your trading experience might be greatly impacted by your choice of trading app. Here are some tips to help you choose wisely:

- Assess your trading style: Consider whether you are a beginner or an experienced trader. Find apps that are appropriate for your level of experience.

- Prioritise security: Ensure that the app has robust security measures in place to protect your personal and financial information.

- Read reviews: Check user reviews and ratings to gauge the app’s performance and reliability.

- Test the app: Many trading apps offer demo accounts or trial periods. Use these to familiarise yourself with the platform before committing.

- Evaluate customer support: Good customer support is crucial, especially for new traders. Ensure the app provides adequate support channels to assist users.

Conclusion

In summary, the best financial trading apps for market derivatives offer a range of features that cater to the needs of traders at all levels. By focusing on user-friendly interfaces, real-time data, advanced analysis tools, and educational resources, these apps empower traders to make informed decisions and execute trades effectively. As you embark on your trading journey, consider the features that matter most to you, and choose an app that aligns with your trading goals. With the right tools in hand, you can navigate the world of market derivatives with confidence and success.